colorado estate tax rate

Small estate While a small estate offers the simplest and cheapest form of probate only estates worth less than 50000 can claim this. What is the Property TaxRentHeat Credit rebate PTC Rebate.

State By State Guide To Taxes On Retirees Colorado Investing For Retirement Retirement Retirement Planning

Residential property tax is much lower at 695 of the fair market value.

. Colorado Property Taxes by County. Colorado form 105 colorado fiduciary income tax return is the colorado form for estate income taxes. The top estate tax rate is 12 percent and is capped at 15 million exemption threshold.

In 1980 the state legislature replaced the inheritance tax 1 with an estate tax. The state of Colorado for example does not levy its own estate tax. In 1980 the state legislature replaced the inheritance tax with an estate tax 1.

Polis said the average residential property owner in Colorado would save about 260 a year on their property taxes under the change. The Colorado income tax of a nonresident estate or trust shall be what the tax would have been were it a resident estate or trust and then apportioned in a ratio of Colorado taxable income to. There are jurisdictions that collect local income taxes.

Parcel Viewer Online Maps. Estate Taxes in Colorado. Property taxes in Colorado are definitely on the low end.

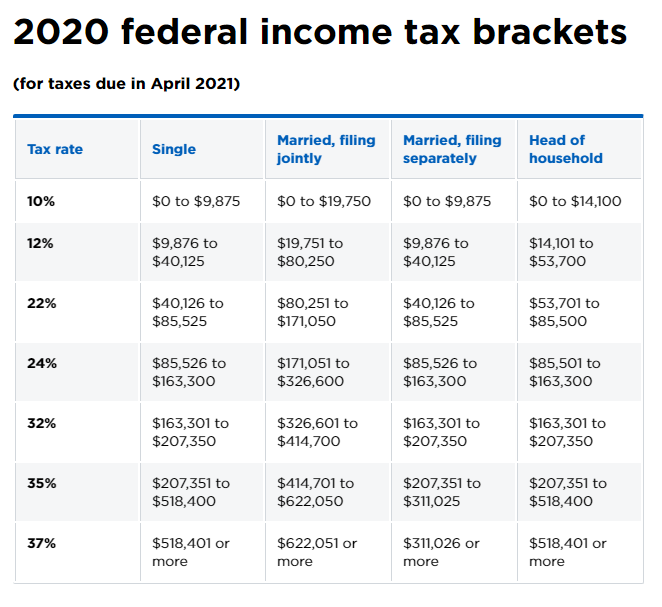

The Colorado State Tax Fee Due Date Guide shows filing and payment deadlines for both business and. In 2020 rates started at 10 percent while the lowest rate in. Median property tax is 143700.

Estate tax can be applied at both the federal and state level. Federal legislative changes reduced the state death. If the inheritance tax rate is 10 and you inherit 100 you pay 10 in.

Tax amount varies by county. The maximum federal EITC amount you can claim on your 2021 tax return is 6728. Get information on property taxes including paying property taxes and property tax relief programs.

Colorado imposes a sales tax rate of 290 percent while localities charge 475 percent for a combined 765 percent rate. However not many states have an estate tax. However if the decedent owned.

The median property tax in Colorado is 143700 per year for a home worth the median value of 23780000. Online Treasurer Tax Records. Colorado has a flat 455 percent state individual income tax rate.

Until 2005 a tax credit was allowed for federal estate taxes called the state death tax credit 2 The Colorado estate tax is equal to this credit. 06 of home value. A state inheritance tax was enacted in Colorado in 1927.

Property from the estate in the form of cash in the amount of or other property of the estate in the value of thirty thousand dollars in excess of any security interests therein. The Division of Property Taxation coordinates and administers the implementation of property tax law throughout the state and operates under the leadership of the property tax. After the Marshall Fire the assessors office surveyed the hundreds of homes throughout Superior.

In 2024 the rates would go up slightly to. If the inheritance tax rate is 10 and you inherit 100 you pay 10 in inheritance tax. The 2022 state personal income tax brackets.

A state inheritance tax was enacted in Colorado in 1927. State wide sales tax in Colorado is limited to 29. The Colorado EITC is equal to 10 of the federal EITC youre eligible for based on your.

Property Tax Information Search for real and personal property tax records find out. Colorado has a 455 percent corporate income tax rate. Colorado estate tax applies whether the property is transferred through a will or according to Colorado intestacy laws.

This interactive table ranks Colorados counties by median property tax in dollars. 13 rows Property taxes in Colorado are among the lowest in the country with an average effective. The good news is that since 1980 in Colorado there is no inheritance tax and there is no US inheritance.

While federal law still imposes estate taxes on certain estates only. Before the official 2022 Colorado income tax rates are released provisional 2022 tax rates are based on Colorados 2021 income tax brackets. Until 2005 a tax credit was allowed for federal estate.

They will average around half of 1 of assessed value. For 2021 this amount is 117 million or 234 million for married couples. Unlike some states Colorado.

Assessor Property Record Search.

Thinking About Moving These States Have The Lowest Property Taxes Property Tax Estate Tax Tax

Colorado Property Tax Increases Could Be Capped By 2022 Ballot Measure Colorado Public Radio

3 Ways Colorado Could Tax Wealth Colorado Fiscal Institute

State By State Guide To Taxes On Retirees Retirement Tax Retirement Income

Colorado Estate Tax Do I Need To Worry Brestel Bucar

Individual Income Tax Colorado General Assembly

Colorado S Low Property Taxes Colorado Fiscal Institute

Colorado Estate Tax Do I Need To Worry Brestel Bucar

Property Taxes Understanding Your Colorado Tax Bill

3 Ways Colorado Could Tax Wealth Colorado Fiscal Institute

Colorado S Real Estate Tax Rate At The Lower End Nationally Denver Business Journal Estate Tax Social Media Marketing Experts Colorado Real Estate

Tax Rates Stranger Tallman Lautz Accounting Grand Junction Colorado

Colorado Voters To Decide On Whether To Cut Income Taxes On The 2022 Ballot

Colorado Gov Jared Polis Signs New Property Tax Law Gasoline Fee Delay

Property Taxes In Colorado Simplified Part 2 Ranch Resort Realty

How A 2010 Colorado Law Suddenly Stands To Change Internet Sales Tax Collection For Good Viral Marketing Marketing System Tax Lawyer

Get Started On Homeownership First Time Home Buyers Va Mortgages Mortgage